Florida’s mortgage market can be as diverse and dynamic as its world-famous beaches. But navigating the Sunshine State’s mortgage landscape doesn’t have to be intimidating. In this blog post, we’ll provide a comprehensive guide to current Florida mortgage rates, various home loan options, and resources for first-time homebuyers and those considering refinancing. So grab your sunglasses and let’s dive into Florida’s mortgage market!

Florida mortgage rates are Lower than the national averages, with a variety of loan types available.

First-time homebuyers can access programs and assistance from Florida Housing Finance Corporation to make homeownership more attainable.

Tips for navigating the Florida mortgage market include working with knowledgeable financial advisors and staying informed of its unique characteristics.

Each individual borrowers financial situation is unique and will be eligible for different rates depending on the lender and loan program that fits the borrower. Contact us and an officer will call you or email you soon.

Florida has always been known for its beautiful weather and vibrant culture, but did you know that it also offers a range of mortgage options for prospective homebuyers? When it comes to current Florida mortgage rates, they are generally lower than the national averages. That said, it’s crucial to shop around and compare mortgage rates from multiple lenders to secure the most competitive rate. After all, even a small difference in interest rates can lead to substantial savings over the life of your loan.

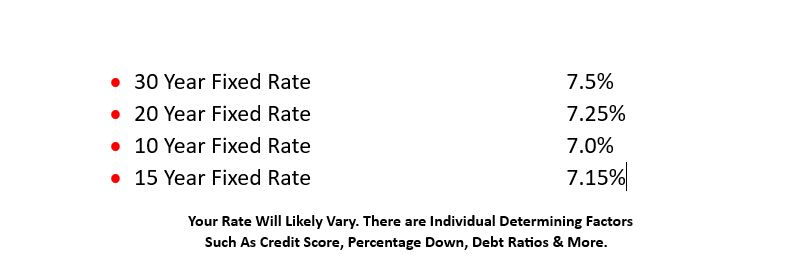

The 30-year fixed-rate mortgage rate in Florida currently averages 8.077, while the 15-year fixed-rate mortgage rate averages 6.78. The 5/1 adjustable-rate mortgage (ARM) rate averages is even less. These mortgage rates in Florida will vary depending on the type of loan and the borrower’s credit profile. It’s essential to explore different mortgage options and consider various factors such as loan terms, interest rates and lender fees before making a decision. Comparing these rates to the national average can provide additional context for borrowers.

When it comes to stability and predictability, fixed-rate mortgages are the go-to choice for many homebuyers. These mortgages maintain a consistent interest rate throughout the term of the loan, unlike adjustable-rate mortgages (ARMs), which can fluctuate with market conditions. The two most popular fixed-rate mortgage options in Florida are the 30-year and 15-year terms, each with its own advantages.

The primary advantage of a 30-year fixed-rate mortgage is that it provides a lower monthly payment than a 15-year fixed-rate mortgage, making it more accessible to borrowers and allowing them to build equity more quickly. On the other hand a 15-year fixed-rate mortgage typically offers a lower interest rate than a 30-year fixed-rate mortgage, thereby enabling borrowers to save money on interest payments over the loan’s duration.

Adjustable-rate mortgages (ARMs) offer an alternative to fixed-rate mortgages for those who are willing to take on a bit more risk. ARMs usually begin with a lower introductory rate than fixed-rate mortgages, but the rate can go up or down depending on market conditions. Contact us for the current rates you qualify for.

While ARMs might seem attractive due to their lower initial rates, they come with potential risks. These include the likelihood of increasing interest rates, resulting in higher monthly payments and the possibility of negative amortization, potentially leading to an increased loan balance.

Moreover, the foreclosure crisis had a significant effect on adjustable-rate mortgages, as many borrowers were unable to keep up with the increasing payments due to the resetting of their interest rates resulting in a large number of foreclosures and a decrease in the availability of ARMs.

As a homebuyer in Florida, you have a variety of loan options at your disposal. From conventional loans to government-backed programs such as FHA, VA, and USDA loans, the Florida mortgage market offers something for everyone. Each loan type comes with its own set of requirements and benefits, so it’s essential to weigh your options carefully before making a decision.

Understanding the differences between these loan types and their unique characteristics can help you make an informed choice and find the best mortgage for your individual circumstances. So let’s explore these home loan options available in the Sunshine State in more detail.

Conventional loans are a popular choice among borrowers searching for a mortgage in Florida. These loans have the following features:

They are sold to Fannie Mae and Freddie Mac

They have stricter requirements than other types of loans

They offer more favorable terms

They are classified as conforming loans, meaning they adhere to the standards set by Fannie Mae or Freddie Mac.

One of the main advantages of conventional loans is their competitive rates and widespread availability. In addition, conventional loans are sold to Fannie Mae and Freddie Mac to be securitized and subsequently sold on the secondary mortgage market. This process helps maintain a stable and functioning mortgage market benefiting both lenders and borrowers.

FHA loans, insured by the Federal Housing Administration (FHA), are designed to help low- and moderate-income borrowers obtain financing for a home purchase. These loans offer several benefits, including:

Lower down payment requirements

More flexible credit requirements

Competitive interest rates

Ability to finance closing costs

Option for fixed-rate or adjustable-rate mortgages

These features make FHA loans an attractive option for many first-time homebuyers.

However, FHA loans generally have higher interest rates than conventional mortgages. Additionally, borrowers are required to pay private mortgage insurance (PMI) when obtaining an FHA loan. This can increase the overall cost of the loan, so it’s essential to weigh the pros and cons of FHA loans before making a decision.

For veterans, active-duty military personnel, and qualifying surviving spouses, VA loans offer a fantastic opportunity to secure a mortgage with favorable terms. VA loans are provided by private lenders and are guaranteed by the Department of Veterans Affairs (VA). These loans offer benefits such as no down payment requirement and no minimum credit score.

One of the most attractive features of VA loans is the ability to roll closing costs into the mortgage. This can significantly reduce the upfront costs associated with purchasing a home, making homeownership more attainable for those who have served our country.

USDA loans, offered by the United States Department of Agriculture (USDA), provide low-interest financing for rural and suburban homebuyers with low to moderate incomes. These loans can be used to purchase a home in an eligible rural or suburban area and offer favorable terms with no down payment required.

To be eligible for a USDA loan, borrowers must satisfy certain income and credit requirements as well as reside in a designated rural area. If you’re considering purchasing a home in a rural or suburban area of Florida then USDA loans can provide an accessible financing option without the need for a down payment.

Florida offers a variety of programs and assistance for first-time homebuyers, making the dream of homeownership more attainable for many residents of the Sunshine State. These programs include down payment assistance and mortgage credit certificates, which can help reduce the financial burden associated with purchasing a home.

Whether you’re a first-time homebuyer or someone who hasn’t owned a primary residence within the past three years, these programs can provide the support and resources you need to navigate the homebuying process with confidence.

Let’s take a closer look at some of the programs and assistance available for first-time homebuyers in Florida.

The Florida Housing Finance Corporation offers various programs to assist first-time homebuyers, such as the Homebuyer Program, State Housing Initiatives Partnership (SHIP), and Predevelopment Loan Program (PLP). One of the most notable programs is the Florida Housing First Time Homebuyer Program, which provides 30-year fixed-rate first mortgages for first-time homebuyers in addition to down payment assistance and closing cost assistance.

Another program worth exploring is the Salute Our Soldiers Military Loan Program. This program offers 30-year fixed-rate mortgages to veterans and active-duty military personnel, as well as up to $10,000 in down payment and closing cost assistance. By taking advantage of these programs, first-time homebuyers in Florida can receive valuable support in achieving their homeownership goals including finding the right loan amount for their needs.

In addition to state-level programs, first-time homebuyers in Florida can also benefit from local and county programs. These programs may include down payment assistance programs and Mortgage Credit Certificates (MCCs). Down payment assistance programs are government-offered programs that provide financial assistance to help cover the cost of a down payment on a home, while MCCs are a type of tax credit designed to reduce the amount of taxes owed on a mortgage loan.

By exploring these local and county programs, first-time homebuyers in Florida can receive additional support and resources to make the journey towards homeownership more attainable. I believe it’s important to research and understand the qualification requirements and individual circumstances for each program, as they may vary depending on your location and financial situation.

Refinancing your mortgage is a common strategy to potentially lower your monthly payments, reduce your interest rate or change the length of your loan. In Florida, you have the option to refinance with a different lender, giving you the flexibility to find the best deal for your unique financial situation. It’s crucial to explore the various refinancing options available, including conventional loans, FHA loans, VA loans, and USDA loans, as well as the High Loan-to-Value Refinance Option from Fannie Mae.

As with any financial decision, refinancing your mortgage in Florida should be approached with care and consideration. It’s essential to understand the current refinance rates, as well as the various programs and assistance available to help you make the most informed decision possible.

As of August 23, 2023, the current mortgage and refinance rates in Florida range from 4.13% to 7.66% for a 15- or 30-year fixed mortgage. Specifically, the 15-year fixed mortgage refinance rate in Florida is 4.13%, while the 30-year fixed mortgage refinance rate stands at 7.66%. Contact us to hear the rate you qualify for.

These rates can change over time and may vary depending on factors such as your credit score, loan-to-value ratio and the amount of equity you have in your home. It’s crucial to stay informed about current refinance rates to ensure you’re making the best decision for your financial situation.

To secure the best refinance rates in Florida, it’s essential to shop around and compare rates from multiple lenders which we can do for you. You can use online mortgage comparison tools to help with this process. Additionally, take steps to improve your credit score by consistently making payments on time, lowering the amount of debt you owe and ensuring any errors on your credit report are corrected.

Another strategy to consider is increasing your equity, either by making additional payments or undertaking home improvements. Finally, don’t be afraid to negotiate with lenders, using multiple offers as leverage to secure the most favorable agreement.

By following these tips, you can increase your chances of finding the best refinance rates in Florida, potentially saving you thousands of dollars over the life of your loan.

One of the unique aspects of the Florida mortgage market is the various taxes and fees associated with obtaining a mortgage. These include commission fees, closing costs and nonrecurring intangible tax. As a homebuyer or homeowner considering refinancing, it’s crucial to understand these costs and how they may impact your overall financial picture.

One program that can help offset some of these costs is the Florida Housing Mortgage Credit Certificate Program. This tax credits program assists first-time homebuyers in reducing their tax burden by allowing them to claim up to 50% of their paid mortgage interest as a tax credit on their federal income tax return, up to a maximum of $2,000 per year. By taking advantage of this program, you can make homeownership more affordable and reduce the impact of mortgage taxes and fees on your financial situation. Find out more at Floridahousing.org

Navigating the Florida mortgage market can be a complex endeavor, but with the right guidance and resources, it’s possible to achieve your homeownership goals. One of the keys to success is understanding the unique characteristics of the Florida mortgage market such as its higher-than-average foreclosure rate, mortgage delinquency rate and rate of mortgage fraud. Being aware of these factors can help you make informed decisions and avoid potential pitfalls.

Working with a financial advisor or great local loan officer knowledgeable about the Florida mortgage market can also be an invaluable resource. They can help you explore various mortgage options, compare rates from multiple lenders and provide guidance on loan terms and fees. Additionally, it’s essential to be aware of the state’s foreclosure process and what to do if you find yourself facing foreclosure.

By staying informed and seeking professional guidance, you can successfully navigate the Florida mortgage market and secure the best mortgage for your needs.

In conclusion, the Florida mortgage market offers a wide range of options for prospective homebuyers and those looking to refinance their existing mortgage. By understanding current mortgage rates, various loan types and available assistance programs, you can make informed decisions that align with your unique financial situation. With the right knowledge, resources, and guidance you can successfully navigate the Sunshine State’s mortgage market and secure the best mortgage for your needs.

Mortgage rates in Florida are currently at 7.66% for a 30-year fixed mortgage and 6.80% for a 15-year fixed mortgage. Shopping around can help you find the best offer. Rates can vary contact us for an update.

Mortgage rates in Florida are currently slightly higher than the national average, but property taxes can help offset this difference. Florida mortgage rates are 2 basis points higher than the national rate.

Mortgage interest rates are currently 7.09% for a 30-year fixed-rate mortgage and 6.46% for a 15-year fixed-rate mortgage, both up by 0.13 and 0.12 percentage points respectively from last week.

This is a great time to consider refinancing your mortgage, as the current rates are still lower than the average rate of 7.48% for a 30-year fixed-rate mortgage and 6.93% for a 15-year fixed-rate mortgage over the past year.

The lowest ever mortgage rate was 2.65%, recorded in January 2021 due to the effects of Covid-19. This would mean a monthly payment of $1,007.41 and total interest paid over the life of the loan of $112,667.41. That rate was without using buydown points.

In Florida, home loan options include conventional, FHA, VA, and USDA loans, offering borrowers diverse choices when it comes to financing a home.

Previous Article

Next Article